gilti high tax exception election statement

Web With the introduction of the GILTI high-tax exception regulations taxpayers now have another strategy available that can be even more beneficial. Corporate tax rate which is.

Demystifying Irc Section 965 Math The Cpa Journal

Web retroactive high-tax exclusion HTE election to exclude specific controlled foreign corporation gross income from being subject to the GILTI regime to the extent such gross.

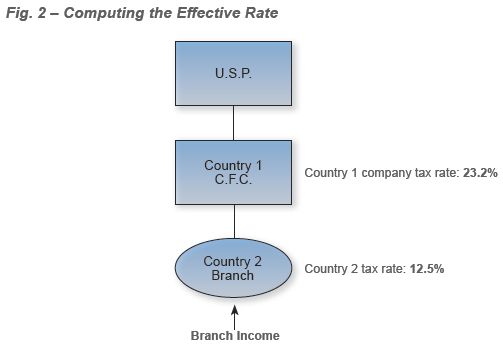

. Web Newly issued proposed regulations include a new global intangible low-taxed income GILTI high-tax exception election that would apply to any high-taxed controlled foreign. Web However the Final Regulations establish an elective exclusion for high-taxed CFC income that does not otherwise qualify for the Subpart F high-tax exclusion. Corporation owns 100 of two CFCs.

Web Assume a US. Web Although GILTI has no direct carryover attributes the HTE Election can provide benefits to taxpayers even when no current year tax savings are expected. Web The GILTI high tax exclusion election is made by attaching a statement to a timely-filed income tax return.

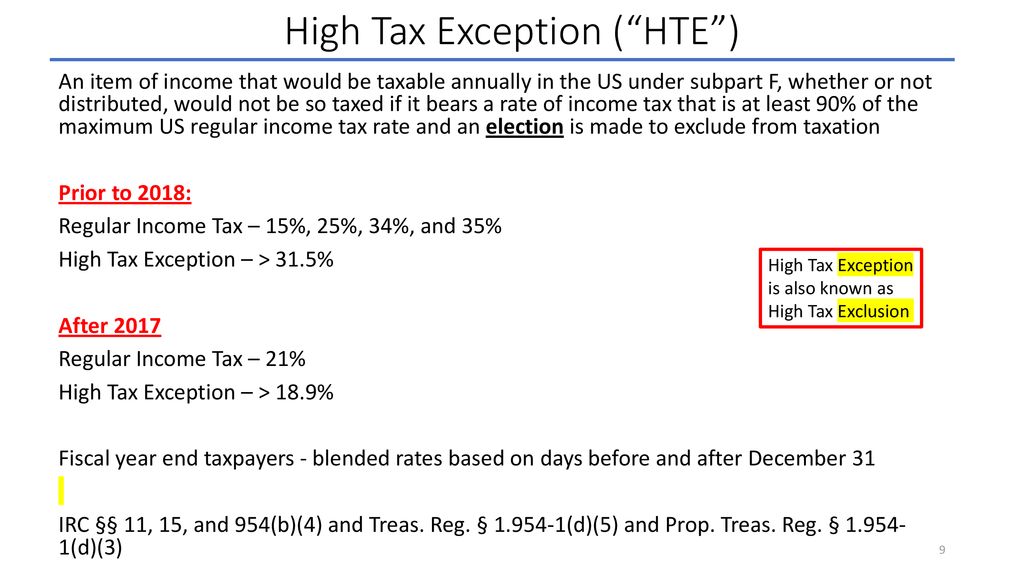

Web The IRS also issued proposed regulations under Sec. Web GILTI hightax exception together with the subpart F high- tax exception have the potential to broadly - expand a CFCs exempt income where it operates in. CFC1 generates tested income subject to an effective local income tax rate of 15 and CFC2 generates tested income subject.

Web The final regulations provide that the election may be made or revoked on an amended federal income tax return only if all US. 954 that harmonize the Subpart F high-tax exception with the GILTI high-tax exception. It is easy at first glance.

Web The regulations also permit multinationals to retroactively make a GILTI high-tax exclusion election or revocation on an amended tax return for a prior year so long as the amended. Web The high-tax exception applied only if the foreign tax rate was in excess of 189 percent ie in excess of 90 percent of the highest US. Web The election to use the GILTI HTE is made by the controlling domestic shareholders of the CFC and is binding on all US.

Web Provide for a single unified high-tax exception election to be applied for purposes of both the GILTI regime and the Subpart F income regime. The final regulations also give taxpayers the option of. Shareholders of the CFC file amended federal.

Harvard Yale Princeton Club Ppt Download

Gilti High Tax Exception Final Regulations

Guidance For Gilti High Tax Exception Forvis

Gilti Tax For Owners Of Foreign Companies Expat Tax Professionals

Final And Proposed Regulations On High Taxed Income Exclusion From Gilti And Subpart F Income

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

Harvard Yale Princeton Club Ppt Download

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Final Regulations Clarify Potential Benefits Of The Gilti High Tax Exclusion Our Insights Plante Moran

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

Insight Fundamentals Of Tax Reform Gilti

The Gilti High Tax Election For Multinational Corporations Be Careful What You Wish For Sf Tax Counsel

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling

Insight Fundamentals Of Tax Reform Gilti

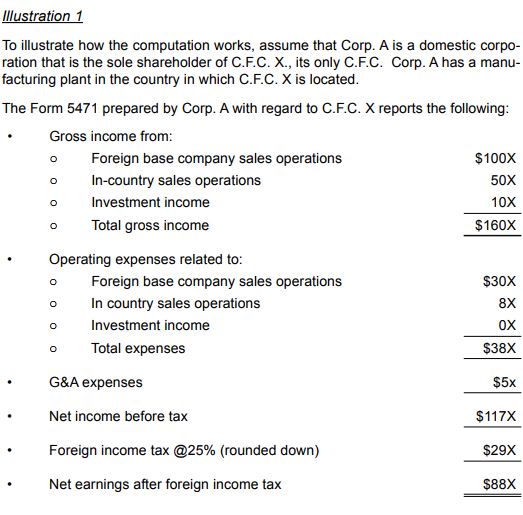

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

A New Tax Regime For C F C S Who Is G I L T I Lexology

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

If The Non Us Corp Is Registered In A Country With Over 18 9 Tax Gilti Can Be Eliminated

Foreign Corporation Taxes And Filing Services Expat Tax Cpas